01-13-2025 DESIGN

Offices are still sitting empty, but that’s about to change

Return-to-office mandates may be only part of the reason offices are repopulating.

[Source Photo: Thomas Barwick/Getty Images]

The national office vacancy rate has hit a new record high, according to the commercial real estate advisory firm Moody’s. But for a variety of reasons, the tide may soon begin to turn.

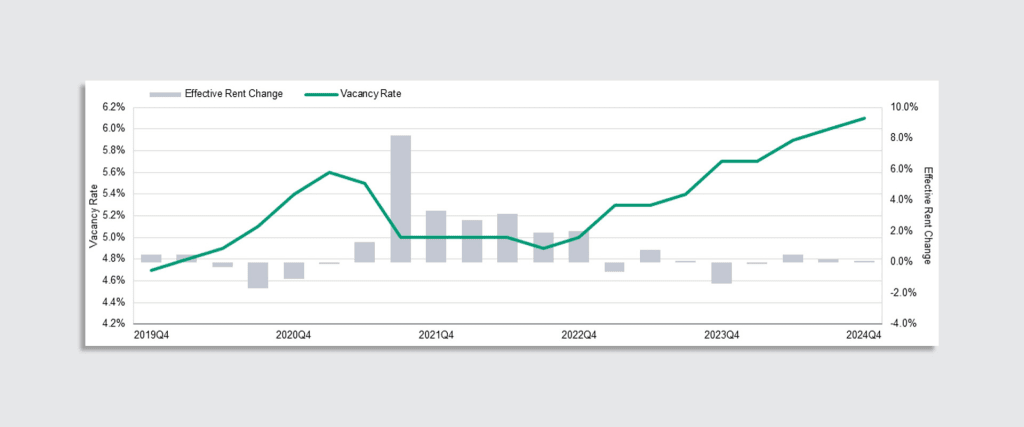

Moody’s year-end report shows that office vacancy reached 20.4% as of the fourth quarter of 2024, 3.6% higher than it was five years ago. That was before the pandemic, and much has changed for office real estate since then, with hybrid work becoming commonplace and companies adjusting their lease terms and office square footage to accommodate uncertainty and lower demand. This new record vacancy rate is a reflection of just how long-lasting the impacts of the pandemic have been on offices.

But the emptying of the American office may soon come to an end. “Over the course of this next year, we’re probably expecting it to eventually bottom out,” says Nick Luettke, associate economist at Moody’s and a coauthor of the year-end report.

Part of the reason is that more companies are once again requiring their workers to come into the office regularly, whether three, four, or five days a week.

Subscribe to the Design newsletter.The latest innovations in design brought to you every weekday

SIGN UP

Another reason vacancy rates may go down is that we’re now five years past the onset of the pandemic, and five years is a common lease term used in office real estate. Large offices that were leased for five years in 2019 only to go nearly empty in early 2020 are now able to have their leases renegotiated or simply not renewed. Any company that found itself with way more space than it needed in the era of hybrid work can simply downsize, saving money and bringing down the overall vacancy rate.

The other side of that coin is that some companies are finding the office space reductions put in place during the pandemic are now causing issues with workplace capacity. “Early on, there was an expectation that firms might look to permanently reduce their foot space in terms of splitting what days are in-office,” Luettke says. “Instead, we’ve seen, even for a lot of hybrid models, there’s bottlenecking effects on those Tuesdays, Wednesdays, and Thursdays. And so that that prevents demand from reducing beyond a certain point.”

During the pandemic many companies reconfigured their spaces for hybrid work, luring workers back to the office by redesigning spaces, providing amenities, or simply moving to newer, nicer buildings. “There’s definitely a flight to quality in terms of the newest construction,” Luettke says. These offices—including one designed for Moody’s—tend to emphasize collaboration over rooms full of individual workstations, meaning they have lower capacities than the typical offices of the recent past. As more companies create or move into these kinds of offices, vacancy will continue to drop.

Counterintuitively, given the vast amount of empty offices around the country, there may also be a shortage of supply—at least of the kind of offices people actually want to move their companies into. Moody’s report shows that construction of new offices was still below pre-pandemic levels in 2024, at just 17.5 million square feet. It’s a trend that’s expected to continue. “Interest rates are going to remain elevated for the next year or two, so that’s going to dampen the construction market,” Luettke says.

It’s difficult to predict exactly when the office vacancy rate will reverse its climb, but record high vacancy rates could be disappearing soon. However, the state of office real estate is likely forever changed, and few expect it to fully recover to what it was in 2019. “Even after we bottom out and have some recovery, in the upcoming years, we’re not expecting to return to pre-pandemic vacancy rates,” Luettke says. That’s looking like it’s very likely out of the question.”

ABOUT THE AUTHOR

Nate Berg is a staff writer at Fast Company, where he writes about design, architecture, urban development, and industrial design. He has written for publications including the New York Times, the Los Angeles Times, the Atlantic, Wired, the Guardian, Dwell, Wallpaper, and Curbed More

Explore Topics

advertisement

Featured Video

of metal screws and string found inside them,

0 of 2 minutes, 34 secondsVolume 0%

Trader Joe’s exposed: The real story behind the quirky grocer

advertisement

advertisement