Germany struggles to fix its pension system

Helen Whittle 16th March 2024

German society is aging fast and the working-age population is shrinking. There are new plans to make the pension system fit for the future, but critics have said they won’t work.

Germany’s baby boomers are retiring. Those born between 1955 and 1969, when the birth rate was at an all-time high, are also living longer. At the same time, the workforce is shrinking. So who will pay the elderly’s pensions?

The pension system in Germany, established in 1889, is based on a public retirement insurance scheme in which the pensions of current retirees are paid using insurance contributions from the currently employed — a system known as the “intergenerational contract.”

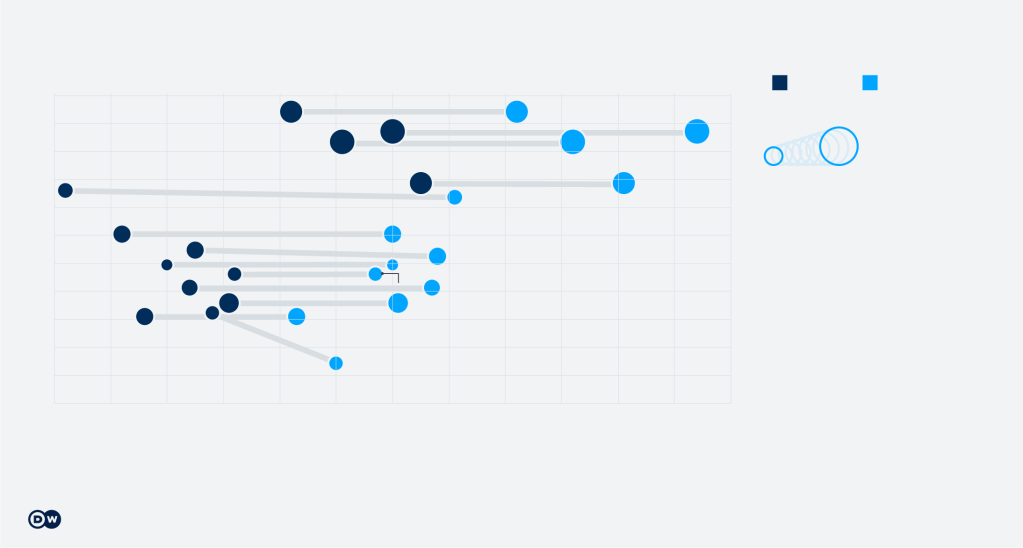

At the beginning of the 1960s, there were still six actively insured workers for every old-age pensioner. Now that ratio is 2:1, and sinking further.

A considerable chunk of the federal budget goes into propping up the pension system: €127 billion ($138 billion) will flow into the retirement fund in 2024, a third of all government spending. This sum is estimated to almost double by 2050, which is bad news in times of high expenditure in other areas such as defense.

At the same time, pensioners constitute a considerable and growing voter base. So safeguarding the pension system has become a topic for heated debate — and for action.

Germany’s three-party center-left coalition government does not want to cut pensions, increase pension contributions or raise the age of retirement beyond the planned increase to 67 by 2029.

https://static.dw.com/image/56970307_605.webp

Being poor in one the world’s richest countries

New ‘Generation Capital’ plan

To solve the problem, Finance Minister Christian Lindner of the neoliberal Free Democrats (FDP) has come up with a plan for the federal government to take out a loan of initially €12 billion and invest it in the stock market.

Specifically, a fund is to be created and administered by an independent public foundation, the so-called “Generation Capital,” that will invest in shares on a “return-orientated and globally diversified” basis with the profits first reinvested in the public purse.

“For more than a century, the opportunities offered by the capital market were left lying around. Now we are investing in the future of this society,” Lindner said on X, formerly Twitter.

The sum of $12 billion is to be increased by 3% annually in subsequent years. By the mid-2030s, the stocks should be worth at least €200 billion to help support the statutory pension scheme.

The main opposition party, the center-right Christian Democrats (CDU), have criticized the plan as ineffective.

Axel Knoerig, deputy chairman of the Committee on Labor and Social Affairs in the Bundestag, told IPPEN.MEDIA that the so-called Pension Package II (“Rentenpaket II”) would “in no way guarantee long-term pension security.” It would “lead to rising contributions in the future and therefore an additional burden for employees,” Knoerig said.

While the CDU is not fundamentally opposed to the idea of investing in the capital market to generate additional income through interest, Knoerig pointed out that the current plan would “not generate any significant returns to offset the additional debt burden.”

Investing in the stock market is also not without risk, but according the German Finance Ministry, a “safety buffer” will be set up to protect the foundation’s assets.

Broadly diversified equity investments generate average of returns of 6 to 8% per year, according to the German Equities Institute. Finance Minister Lindner said he expects “more than 3 or 4% returns.”

Germany’s statutory pension system, explained

In Germany, the public pension scheme, also referred to as statutory pension insurance, is mandatory only for employees. The self-employed may pay into the state system or rely entirely on private insurance schemes. Civil servants have their own pension system. These two groups make up around 12% of the working population.

Many left-leaning politicians insist the only way to save the state-run system is by forcing all members of these well-paid groups of people to pay into the state retirement fund.

Germany’s labor shortage: Lufthansa turns to retirees

https://static.dw.com/image/65571724_605.webp

A contribution of 18.6% of an employee’s gross monthly salary goes into the state retirement fund, with the employee and the employer each paying half. The monthly contribution cannot exceed €1,404.30.

The government expects the contribution rate to rise to 20% from 2028, going up to 22.3% by 2035, where it expects it to remain until 2045.

The current “pension level” — the amount paid to retirees each month — is 48% of the average monthly salary in Germany, a percentage the federal government wants to guarantee in law until 2040 with the “level protection clause.”

In 2023, the average old age monthly pension in Germany was €1,550, according to the German Pension Insurance.

What if the state pension isn’t enough?

Current figures from German Pension Insurance show that 61% of pensioners receive less than €1,200 net per month from their statutory state pension. One in three pensioners receive less than €750 net.

Many women in Germany receive much lower pensions, or none at all. That’s because they worked in low-paid jobs, and many also spent years at home as a stay-at-home wife, often not returning to work long after having children.

Reentering the labor market after many years isn’t easy, and for many a pension isn’t enough to make ends meet. They either work to supplement their pensions or receive state welfare benefits.

https://www.dw.com/webapi/iframes/widget/en/65417146

Sahra Wagenknecht, a former Left Party politician who this year founded her own populist party BSW, has announced that she intends to campaign on the topic of pension security in upcoming elections.

Her alliance is to be the “voice of German pensioners,” she told the Augsburger Allgemeine Zeitung newspaper in March. “Pensions are probably the biggest social problem of our time,” said Wagenknecht, adding that the fact that many people receive a low pension despite decades of contributions is a “sociopolitical scandal.”

In addition to the government-run statutory pension insurance system, there are also private company plans and several options for private individual retirement investment plans.

As well as periods in contributory employment, time spent raising children, in education, unemployment or illness also count toward pensions.

Foreigners who worked and paid contributions in Germany for more than 60 months are entitled to receive a German pension after reaching the official German pensionable age.

More information in English about the German public retirement system can be found here.

Edited by: Rina Goldenberg

While you’re here: Every Tuesday, DW editors round up what is happening in German politics and society. You can sign up here for the weekly email newsletter Berlin Briefing.

https://www.dw.com/webapi/iframes/widget/en/56812933

Send us your feedback

YOUR FEEDBACK